Mobile Money in Africa

Market Overview & Potential:

African consumers are seeking accessible and affordable digital financial services, including savings, credit, insurance, and a comprehensive marketplace. There's a need for an integrated solution that allows customers to interact, transact, and send money within Africa and globally.

Market Statistics & Potential:

- Africa's population is 1.2 billion, with 700 million millennials (ages 18-36).

- 400 million Africans currently use smartphones, projected to increase to over 700 million by 2025.

- Financial inclusion is expected to reach an average of 43%.

- The forecasted market opportunity for digital financial services in Africa is $102 million by 2025.

HelloCash Wallet:

The HelloCash wallet, part of the BelCash Mobile Money platform, is a versatile payment system that works with global payment networks, including international cards, mobile wallets, bank accounts, and cash transactions. It's designed to connect Africa with the global payment community through an open-loop system. Unlike traditional mobile money services, HelloCash allows complex, cross-border financial transactions and supports multiple currencies.

Partnership Approach:

HelloCash operates on a partnership basis with various payment providers to ensure seamless interoperability. Collaborations with banks, mobile money services, and international payment networks aim to simplify the process of funding HelloCash wallets, similar to services like PayPal and Revolut.

HelloCash Wallet KYC (Know Your Customer):

The KYC process for HelloCash includes basic identification measures and additional payment-related information. It also requires KYC for any linked wallets used as funding sources.

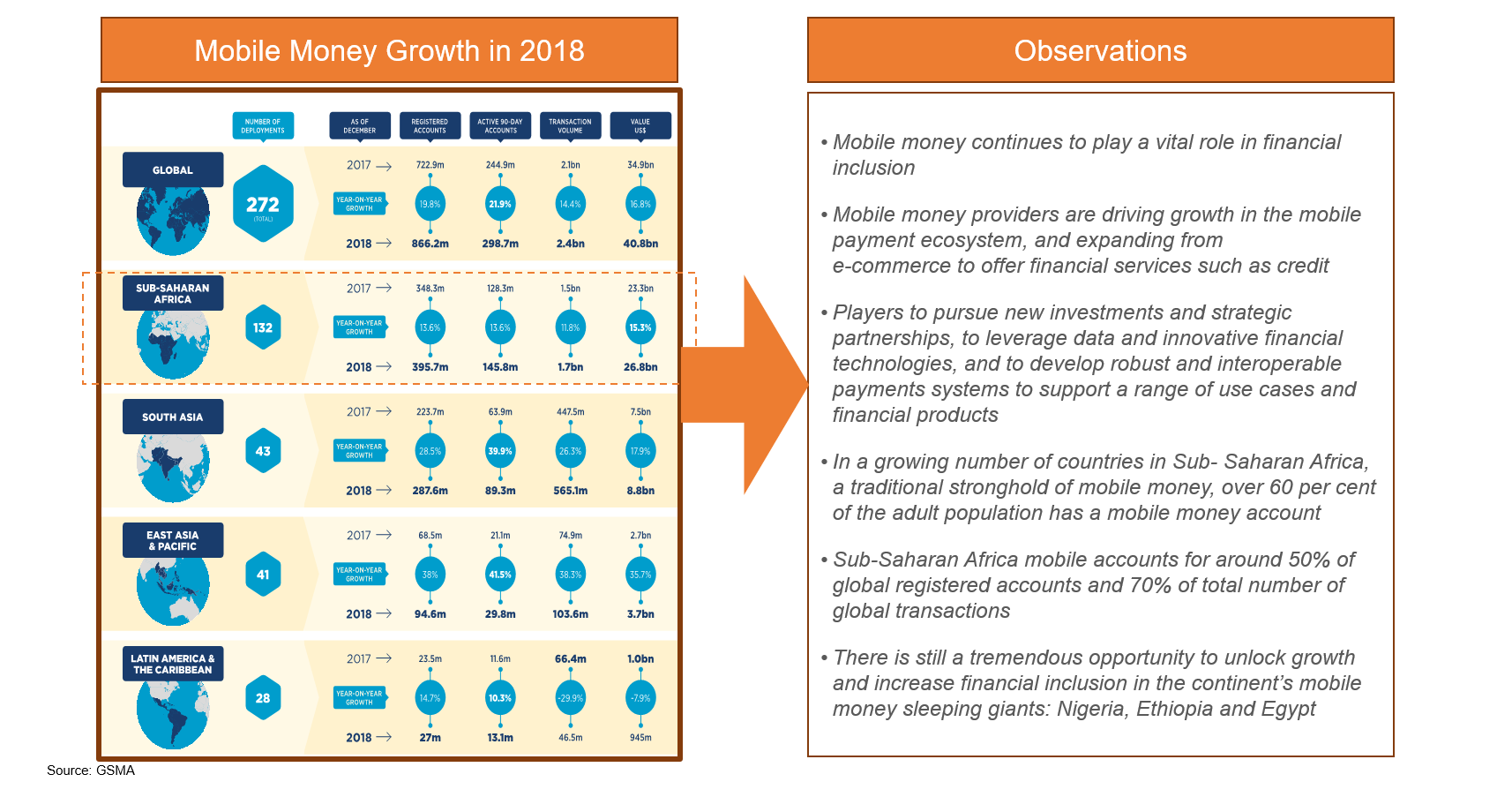

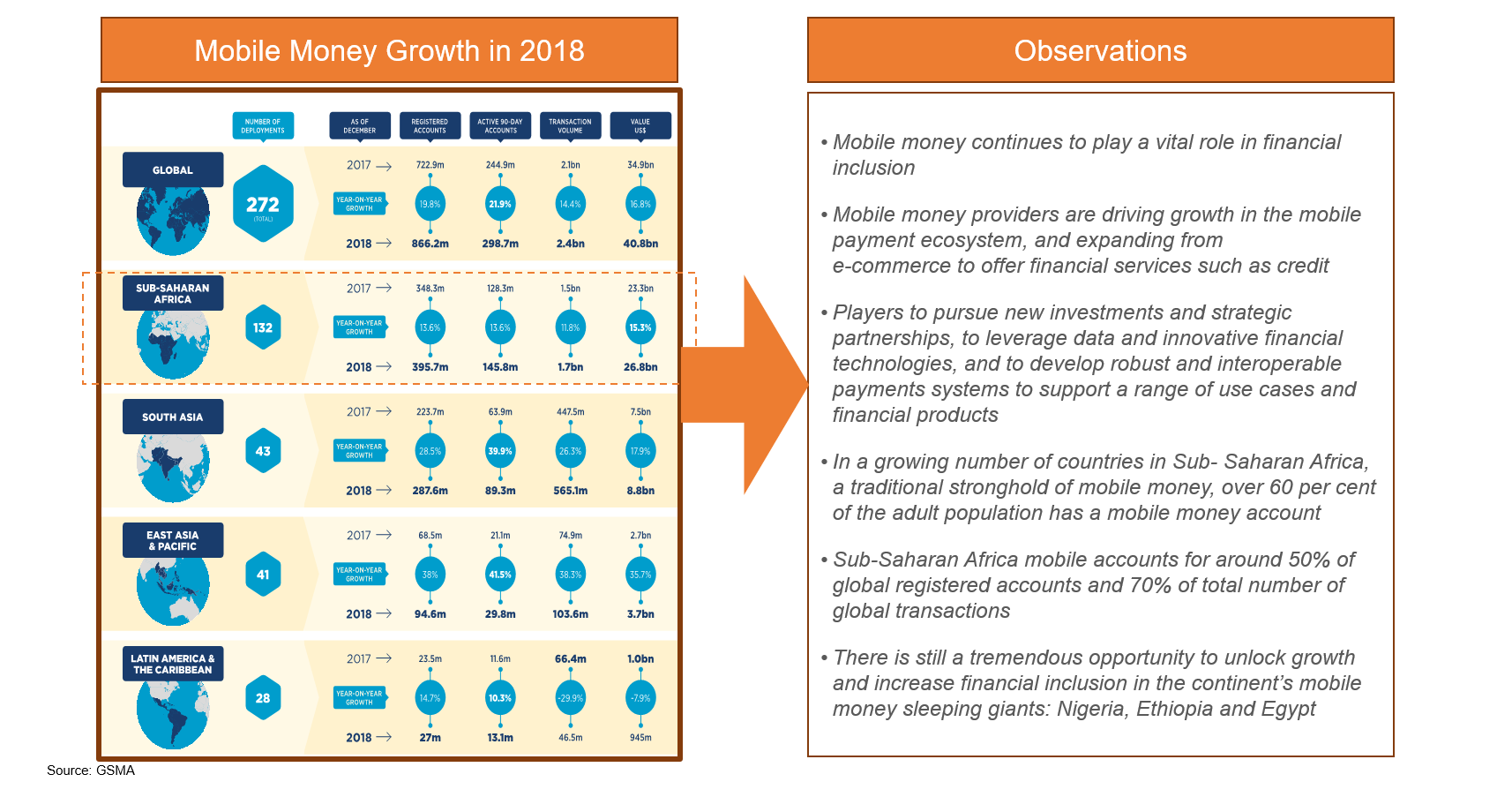

Africa Continues to be the Mobile Money Hub

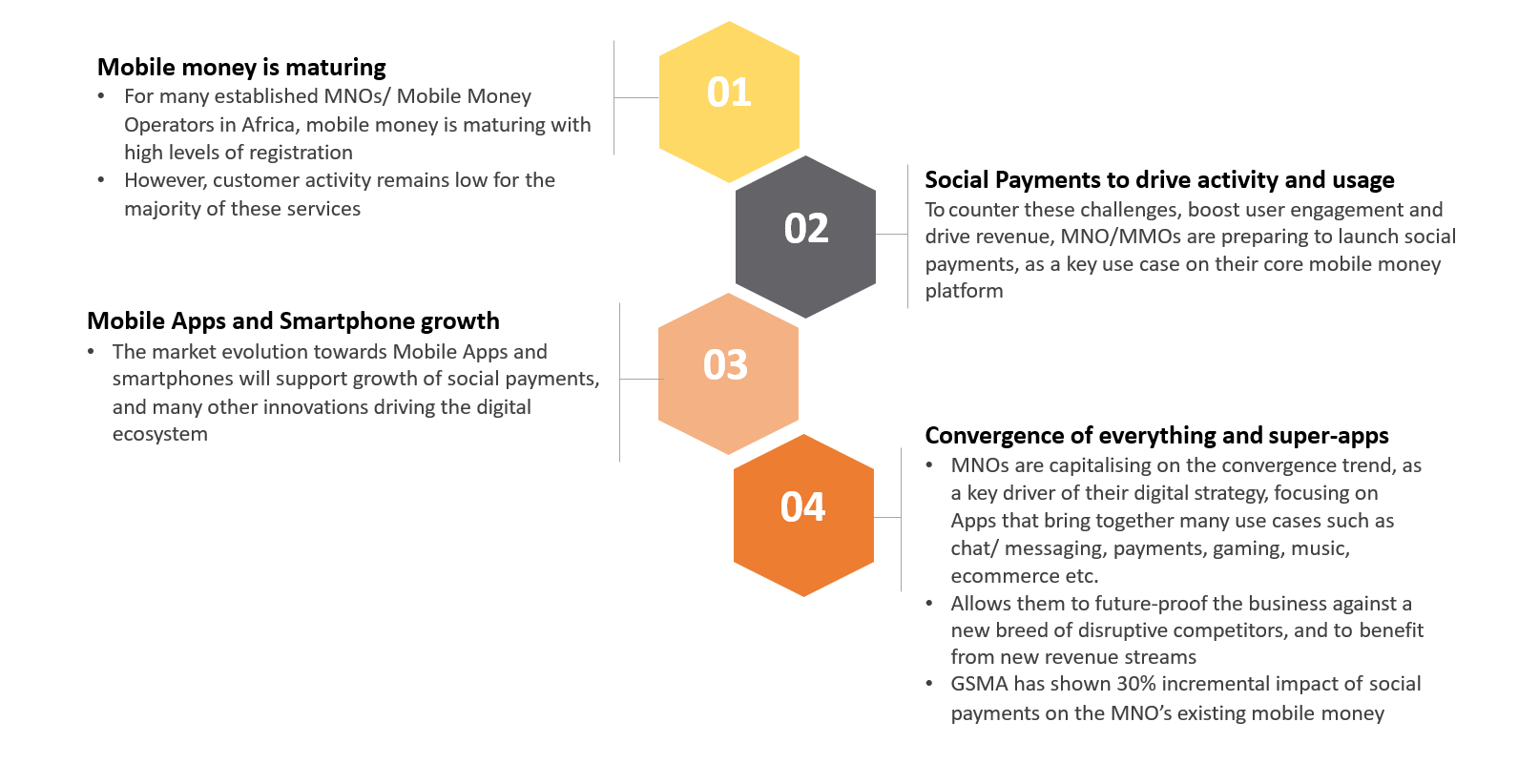

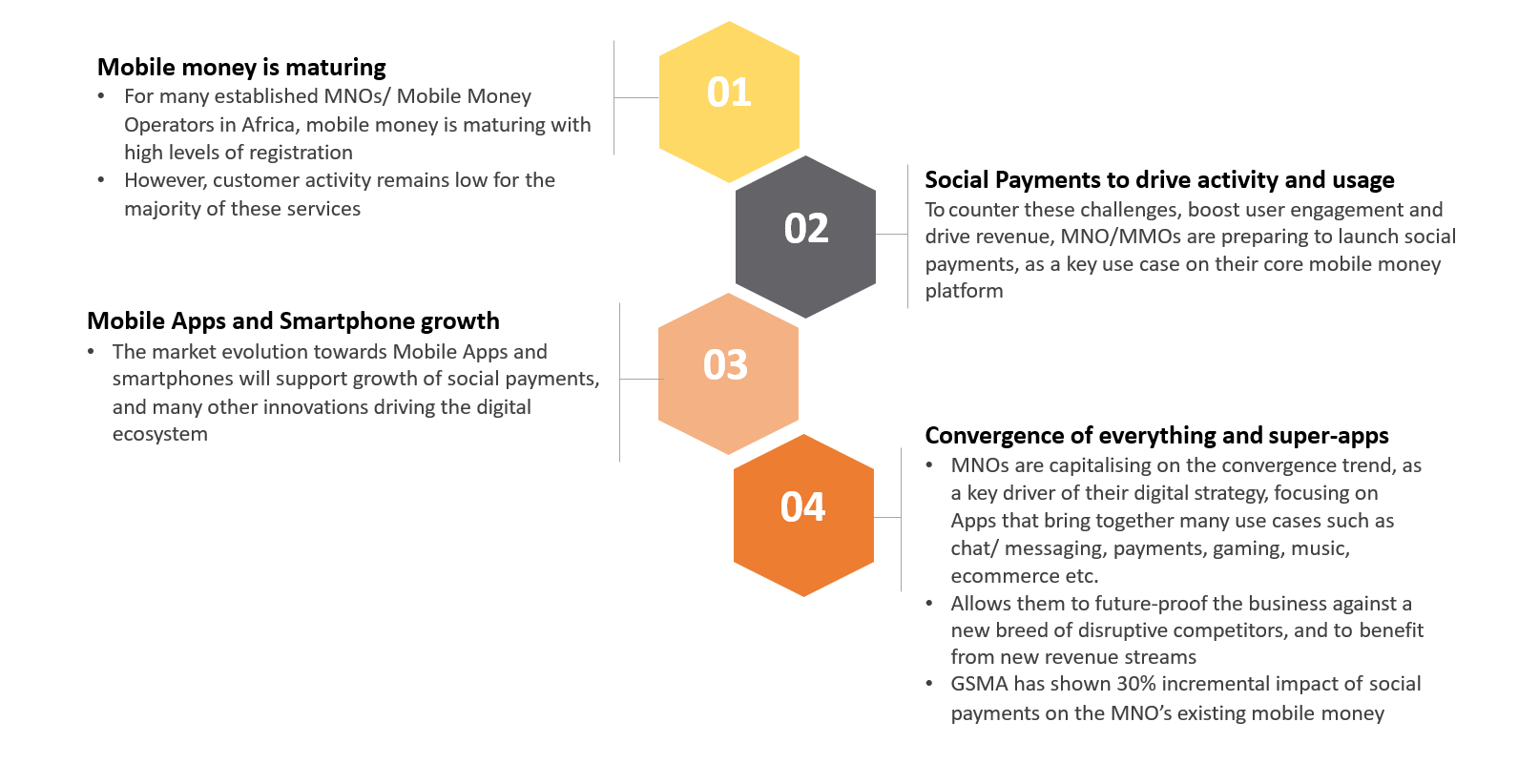

Social Payment Rational

African consumers are seeking accessible and affordable digital financial services, including savings, credit, insurance, and a comprehensive marketplace. There's a need for an integrated solution that allows customers to interact, transact, and send money within Africa and globally.

Market Statistics & Potential:

- Africa's population is 1.2 billion, with 700 million millennials (ages 18-36).

- 400 million Africans currently use smartphones, projected to increase to over 700 million by 2025.

- Financial inclusion is expected to reach an average of 43%.

- The forecasted market opportunity for digital financial services in Africa is $102 million by 2025.

HelloCash Wallet:

The HelloCash wallet, part of the BelCash Mobile Money platform, is a versatile payment system that works with global payment networks, including international cards, mobile wallets, bank accounts, and cash transactions. It's designed to connect Africa with the global payment community through an open-loop system. Unlike traditional mobile money services, HelloCash allows complex, cross-border financial transactions and supports multiple currencies.

Partnership Approach:

HelloCash operates on a partnership basis with various payment providers to ensure seamless interoperability. Collaborations with banks, mobile money services, and international payment networks aim to simplify the process of funding HelloCash wallets, similar to services like PayPal and Revolut.

HelloCash Wallet KYC (Know Your Customer):

The KYC process for HelloCash includes basic identification measures and additional payment-related information. It also requires KYC for any linked wallets used as funding sources.

Africa Continues to be the Mobile Money Hub

Social Payment Rational