PaaS

Platform as a Service

About Us

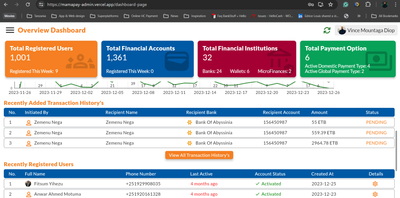

World Open Service R&D (WOS) is a tech company based in the Netherlands and is a wholly-owned subsidiary of WOS Holding. Our mission is to develop and maintain innovative platforms for Mobile Money, Digital Banking, eCommerce, Digital Trade Financing, Smart m-POS, eGateways, QR codes, and Remittance services, all provided through our super Platform as a Service (PaaS) business model.

As an international provider of digital services, we ensure secure and efficient access to mobile financial services for the African market. Our business-to-business (B2B) offerings empower financial institutions, mobile network operators, fintech companies, money transfer organizations, retailers, NGOs, and corporations by providing the necessary infrastructure to enhance connectivity between individuals, businesses, and financial entities.

Established in 2010, our network extends throughout Africa and its diaspora communities. We link over 15,000 merchants and 25,000 agents with 1,700 goods suppliers and various financial institutions, remittance service providers, and mobile operators to serve over 2.5 million end-users.

Our platforms began operating in Ethiopia in 2015 and quickly became a leader in the local market with over 300 million transactions totaling more than 4.5 billion USD. We are expanding our reach to connect Eastern and Western Africa and aim to become a key player in the continent's Digital Banking and Digital Trade Financing sectors by 2025.

As an international provider of digital services, we ensure secure and efficient access to mobile financial services for the African market. Our business-to-business (B2B) offerings empower financial institutions, mobile network operators, fintech companies, money transfer organizations, retailers, NGOs, and corporations by providing the necessary infrastructure to enhance connectivity between individuals, businesses, and financial entities.

Established in 2010, our network extends throughout Africa and its diaspora communities. We link over 15,000 merchants and 25,000 agents with 1,700 goods suppliers and various financial institutions, remittance service providers, and mobile operators to serve over 2.5 million end-users.

Our platforms began operating in Ethiopia in 2015 and quickly became a leader in the local market with over 300 million transactions totaling more than 4.5 billion USD. We are expanding our reach to connect Eastern and Western Africa and aim to become a key player in the continent's Digital Banking and Digital Trade Financing sectors by 2025.

Easy payments

Pay with a "Hello" and smile

Mobile Money

Multi-Currency Management

The wallet supports the creation and management of multiple currencies. With capability for currency conversions and tracking of exchange rates.

Fees and Tax Management

The wallet has a module for creating and managing transaction fees and these are configurable per use case per currency per market.

Tax management and configuration available in specific markets for tax segments that include IMT and withholding tax amongst others.

Limits Management

All wallet transactions are governed by limits. The wallet has a limits module used for creating and validating limits based on the KYC supplied by the customer. HelloCash wallet KYC compliance is based on the linked payment method in the source market.

Stocks Creation & Liquidation

The wallet has a stocks creation and liquidation module used for managing deposits and withdrawals into and out of the system by various channel users such as merchants and bulk payers.

Channel User Management

The wallet supports the following channel users-:

Merchants, Billers, Bulk Payers, Agents, Payroll. These users have a self-onboarding and self-care portal for accessing HelloCash Services.

Charts of Accounts

The wallet has a module that manages channel user accounts, system expense, suspense and income accounts, mirror trust accounts and customer accounts. Journal entries for each of the accounts are recorded and a running balance tracked for each of the accounts. Automated reconciliation of accounts is available.

Risk and Fraud Management

The wallet has a sanctions screening module for managing risk. It also has an AI based fraud dictation module for anti-money laundering gate-keeping.

Services and Relationships Management

The wallet has a module for managing allowable transaction types and services across channel users and markets. The module also manages relationships between channel users and customers.

Loading and Unloading Wallet

Customers can load their HelloCash wallet using local currencies via banks, mobile money, payment and card schemes and cash.

Loading funds into HelloCash is restricted to HelloCash seven currencies and any other currency has to be converted into either base currency, USD or any other HelloCash acceptable currency.

Customers can transfer funds from HelloCash wallet to cash, bank account and mobile money wallet.

Domestic Transfers

Peer to peer transfer of funds for customers within the same country based on HelloCash country.

Remittances

Customers can seamlessly and at a low cost send money in several currencies to friends and loved ones across the world. Remittances will be restricted to countries that we are licensed to participate in either directly (BelCash remit) or indirectly ( Partnerships with other remittance partners)

Merchant Payments

The customer can pay HelloCash merchants on the pay page, on the explore page and any other online and brick and mortar merchants registered on HelloCash.

HelloCash debit card and virtual payments may be utilized for both present and non-present transactions.

Bill Payments

The customer can pay HelloCash Billers and any other billers integrated to HelloCash Pay. HelloCash shall also allow customers to setup recurring payments for bill payments together with bill presentation from merchants.

Currency Exchange

The customer has access to currency exchange services which they can use within their multi-currency wallet as need arises, conveniently and at a low cost

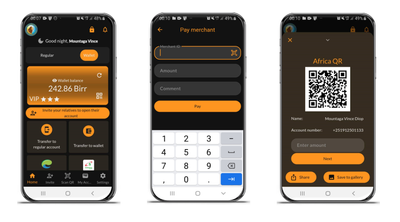

Scan to Pay

The customer can scan to pay (stream lined brick and mortar services). The customer can also generate a QR Code to be scanned for them to be paid or receive money.

QR code channel is globally compatible with all QR codes that include MasterCard, Union Pay and VISA.

Scan QR codes feature is also compatible for product verification and comparison.

Wallet Services

The customer can access the following wallet services-:

- Self-service micro services

- HelloCash wallet services that include balance inquiry, statement etc.

- Password Management

Visit one of our platforms: HelloCash Info HelloCash Portal

Youtube illustration: Send Money tutorial

To know more contact us.

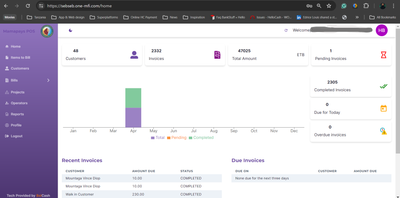

Neo Banking - Onecash

OneCash offers a wide range of services, including:

- Checking and savings accounts

- Mobile money accounts

- Easy payments and money transfers

- Microloans

- Bill payments

- Interbank transfers

- International remittances

- Etc.

From a regulatory standpoint, your neobank can operate with its own banking license and establish partnerships with traditional banks for additional services like clearance and settlement.

OneCash stands out for its ability to integrate with various trading platforms and includes an m-POS system, QR code management, biometric security options, debit card services, and a digital marketplace. This makes it possible for merchants to become banking agents.

Most importantly, OneCash is a secure platform that can be up and running in just 60 days, training included.

Visit one of our platforms: OneCash Info OneCash request loan

Youtube illustrations: NeoBanking the Next Economy

To know more contact us.

eCommerce

Currently, over 1,700 SMEs are utilizing our platform to showcase their products, and HellOOmarket successfully delivered more than 69,000 items.

HellOOmarket accommodates a variety of payment methods, ranging from mobile money to major international options like Visa, Mastercard, and PayPal. We also offer comprehensive delivery options through both local and international carriers such as DHL and UPS.

HellOOmarket sales process is seamlessly integrated with social media channels for marketing and customer engagement. Customers can place orders through a simple phone call, their preferred messaging app, web applications, QR codes, or other channels that suit their needs.

We pride ourselves on our all-in-one customer support platform that combines voice, email, and chat communications with a unified backend portal for a streamlined customer service experience.

Visit one of our sites: HellOOmarket.com HellOOmarket Backend

Youtube Illustration: HellOOmarket Showroom Order via Telegram Bot How HellOOmarket works?

To know more contact us.

m-Trading - Helloopay

1. Flexible Payment Solutions : HellOOpay with BNPL allows immediate purchases with deferred payments, boosting customer buying power and increasing business sales.

2. Increased Conversion Rates : BNPL options on HellOOpay reduce cart abandonment as customers appreciate the flexibility to not pay in full immediately.

3. Enhanced Customer Loyalty : Offering adaptable payment plans meets diverse budgeting needs, fostering customer satisfaction and loyalty.

4. Competitive Advantage : Businesses providing BNPL through HellOOpay stand out, attracting customers desiring payment flexibility.

5. Improved Cash Flow : Businesses receive full payment upfront from the BNPL provider, despite customers paying over time, ensuring reliable cash flow.

6. Risk Mitigation : HellOOpay's BNPL service includes an AI-powered credit scoring platform, minimizing the need for businesses to assess customer creditworthiness.

7. Market Expansion : BNPL opens markets to a wider audience, including those without immediate funds or traditional credit access.

8. Seamless Integration : HellOOpay's BNPL feature integrates effortlessly with existing checkout processes, ensuring a smooth experience for all parties.

Incorporating BNPL, HellOOpay retains benefits like streamlined transactions, lower costs, and robust security while presenting innovative growth and loyalty-building opportunities for businesses in the trading sector.

Our eWallet ecosystem, TheStore, is uniquely designed with a complete value chain incorporating dedicated apps for:

- Raw material suppliers

- Aggregators

- Processors

- Distributors

- Retailers

- Consumers

All participants benefit from our integrated eCommerce platform, in-store payments, and access to BNPL options within our network. TheStore acts as an open ecosystem where revenue streams are generated through BNPL fees, eCommerce services offered to members, and the strategic use of data analytics.

Visit one of our sites: HellOOpay Store Backend

Youtube Illustration: HellOOpay BNPL

To know more contact us.

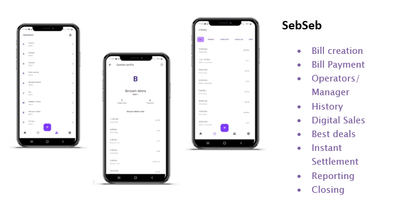

Smart mPOS

SebSeb enables SMEs to shift towards digital payments, moving away from cash dependency. It provides a variety of secure payment methods, including mobile money, QR codes, and online payments, making transactions smoother for customers.

The platform is crafted for simplicity, allowing SMBs to manage their finances better, streamline their services, and offer their customers a better shopping experience. SebSeb aligns with many African nations' goals to advance digital economies, helping to increase financial inclusion and assisting businesses in adapting to new commercial trends.

In essence, SebSeb is a robust digital payment solution that equips financial institutions with a tailored mPOS application. It helps businesses leverage digital payment advantages, improve operations, elevate customer service, and support the broader objective of creating a cash-lite society.

Visit one of our sites: SebSeb Info SebSeb Backend

Youtube illustrations: SebSeb Smart mPOS - Pay Bills

To know more contact us.

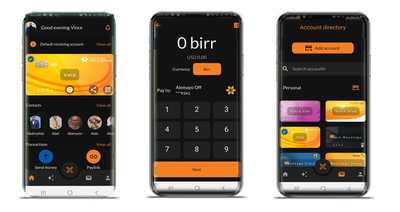

Mamapays - Cybersource

Unlock a world of convenience and innovation for your customers by integrating Mamapays Unified Payment app with your banking services. Mamapays offers a suite of benefits designed to propel your bank into the future of financial transactions:

- Effortless Integration : Seamlessly incorporate Mamapays into your existing infrastructure, providing a smooth transition for both your bank and your customers.

- Volume Expansion : Watch your transaction volumes soar as customers enjoy the ease of making payments through Mamapays.

- Deposit Growth : Enhance your deposit mobilization strategies with an app that encourages frequent and consistent use.

- Global Reach : Break down borders with remittance and international payment solutions that cater to a global customer base.

- Cost Efficiency : Save on the substantial costs of in-house development while still offering a cutting-edge payment solution.

- Data Insights : Gain valuable insights from new data streams, enabling better decision-making and tailored services.

- Customer Satisfaction : Enhance your value proposition by providing an app that adds significant convenience and functionality to your customers' daily lives.

By adopting Mamapays Unified Payment app, your bank will not only drive growth and customer satisfaction but also solidify its reputation as a progressive leader in the financial sector.

Introducing Mamapays UP App

The Mamapays Unified Payments App (UPapp) is a revolutionary App that consolidates multiple bank accounts into one user-friendly mobile application. It integrates numerous banking functions, facilitates seamless fund transfers, merchant payments, and even handles peer-to-peer payment requests that can be scheduled and fulfilled at the user's convenience.

In a bold move, BelCash has unveiled its UPapp platform under the Mamapays brand. End-users are invited to join the financial revolution by downloading the Mamapays UPapp from the Google Play Store or Apple Store. Experience firsthand why the initial release of Mamapays is not just an app but a gateway to financial empowerment.

Visit one of our sites: Mamapays backend Mamapays Info

Youtube illustration: Mamapays the mother of all Payment

To know more contact us.

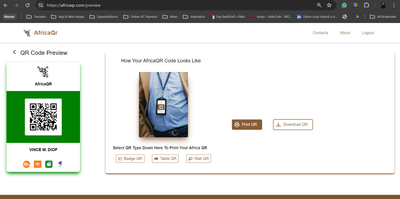

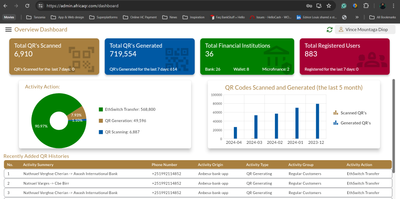

AfricaQR

Additionally, with its advanced QR code scanning capabilities, AfricaQR Manager can instantly extract the encoded information for quick access. This powerful tool also offers functionality for managing and tracking the performance of QR codes through features like location data of scans, user demographics and real-time analytics on the number of scans. AfricaQR transform your financial services experience,

Merchant benefits:

- Convenience: QR code payments are quick, easy and convenient for consumers to use. All they need is a smartphone with a camera and a QR code scanning app to make a payment.

- Security: QR code payments are considered more secure than traditional payment methods like cash or credit cards. They use encryption to protect user data and are less vulnerable to fraud or theft.

- Cost-effective: QR code payments are a cost-effective option for merchants as they don’t require expensive point-of-sale (POS) machines or card readers. All they need is a printed QR code that can be easily generated.

- Speed: QR code payments are fast and efficient, allowing for quicker and smoother transactions that benefit both the customer and the merchant.

- Accessible: QR code payments are accessible to everyone, regardless of whether they have a bank account or not. They can be used by anyone with a smartphone, making them an inclusive payment option. Overall, QR code payments are a convenient, secure, cost-effective, fast and accessible way for consumers and merchants to make and receive payments.

Visit our sites: AfricaQR Backend Africa QR Generator AfricaQR General Info

To know more contact us.

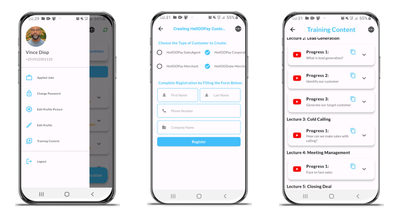

Unified KYC

HellOOkyc, a cutting-edge platform developed by BelCash, revolutionizes the way door-to-door sales agents engage customers for digital services. Its distinctive feature lies in centralizing the main Know Your Customer (KYC) data within a singular database. This innovation ensures that, with customer consent, their verified KYC information can be seamlessly leveraged across a multitude of digital services, including banking, ride-sharing like Uber, and various e-commerce platforms.

The forthcoming integration of PIN code management and biometric authentication will further empower users to securely authorize the use of their data across these services.

Moreover, HellOOkyc boasts exceptional management capabilities. Gig workers and independent professionals can join the platform and immediately begin their journey after undergoing online training provided by expert trainers and comprehensive tutorials.

Linked directly to an eWallet, the platform ensures that commissions earned by door-to-door sales representatives are promptly credited following data verification. These earnings are readily accessible and can be withdrawn at any bank of their choosing. The system also simplifies tax calculations and receipt issuance, streamlining the entire financial process.

At the heart of HellOOkyc is a sophisticated role management system. This system meticulously outlines supervisory hierarchies, data sharing permissions, operational locations, and campaign assignments for agents on the ground.

In the near future, we are excited to unveil a feature that will transform customer agreement management. Users will be able to upload and categorize signed agreements digitally. The physical documents can then be collected at a convenient time, whereupon our dedicated back-end team will verify their authenticity. Upon confirmation, the customer's chosen services will be activated in mere minutes.

HellOOkyc is not just a platform; it's a comprehensive ecosystem designed to enhance the efficiency and security of digital service onboarding, offering unparalleled convenience for both service providers and their customers.

Visit the site of one of our customers using the platform: Partner Site (Using the platform) Partner Backend

To know more contact us.

eConnect API

HelloConnect is designed to empower financial institutions and mobile carriers by providing them with the necessary infrastructure to:

1. Enable users of our HelloCash payment platform to easily recharge airtime or top-up digital wallets.

2. Facilitate seamless integration with major Remittance Service Providers (RSPs).

Some of the RSPs leveraging HelloConnect to link their services with our mobile money platform include:

- TransferTo

- Remitly

- Tawakal

- Small World

- MFS Africa

- Western Union

- MPESA

- Airtel Money

- MTN Mobile Money

- Ria Money Transfer

- Mastercard

- Visa

3. Integrate our HelloCash platform with your Core Banking System (CBS), enhancing the synergy between mobile and traditional banking services.

HelloConnect processes over one million top-ups monthly, demonstrating its extensive reach and reliability in the digital transfer space.

Visit one of our partners using our platform: La poste remittance Djibouti

To know more contact us.

International Remittance

We integrate your platform to the best!

The fastest growing immigration

Send money in Africa

The WOS HelloConnect platform is an innovative digital platform designed for transferring mobile top-ups and data solutions. It provides essential infrastructure and services to financial institutions and mobile operators, enabling:

1. Users of our HelloCash payment system to easily recharge their airtime or other digital wallets.

2. Seamless integration of your current systems with major Remittance Service Providers (RSPs), connecting them particularly to the African and Ethiopian markets.

3. Connection of our HelloCash platform with your Core Banking System (CBS) for streamlined financial operations.

HelloConnect processes over one million top-ups every day, demonstrating its widespread use and reliability.

1. Users of our HelloCash payment system to easily recharge their airtime or other digital wallets.

2. Seamless integration of your current systems with major Remittance Service Providers (RSPs), connecting them particularly to the African and Ethiopian markets.

3. Connection of our HelloCash platform with your Core Banking System (CBS) for streamlined financial operations.

HelloConnect processes over one million top-ups every day, demonstrating its widespread use and reliability.

Mobile Money in Africa

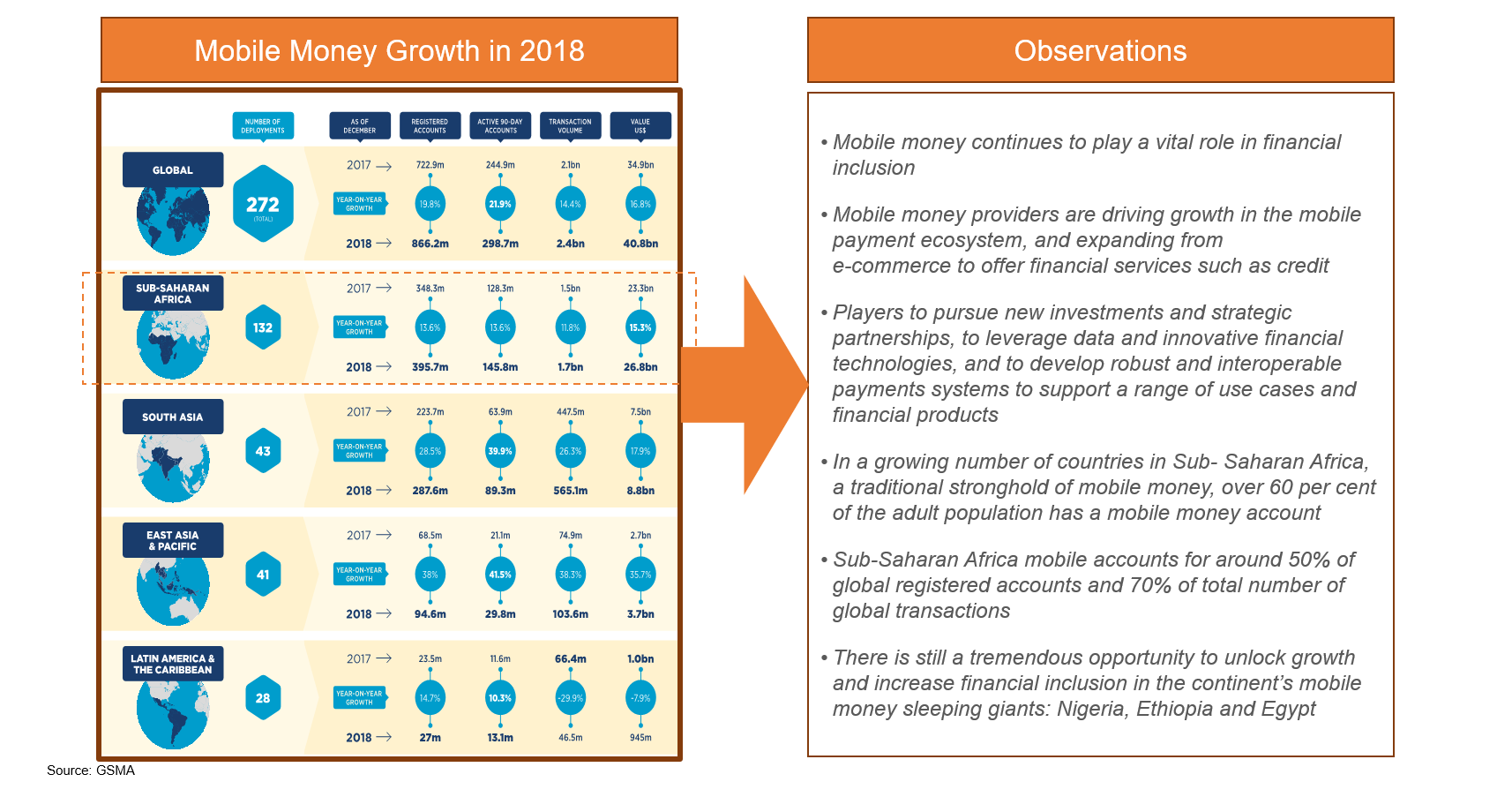

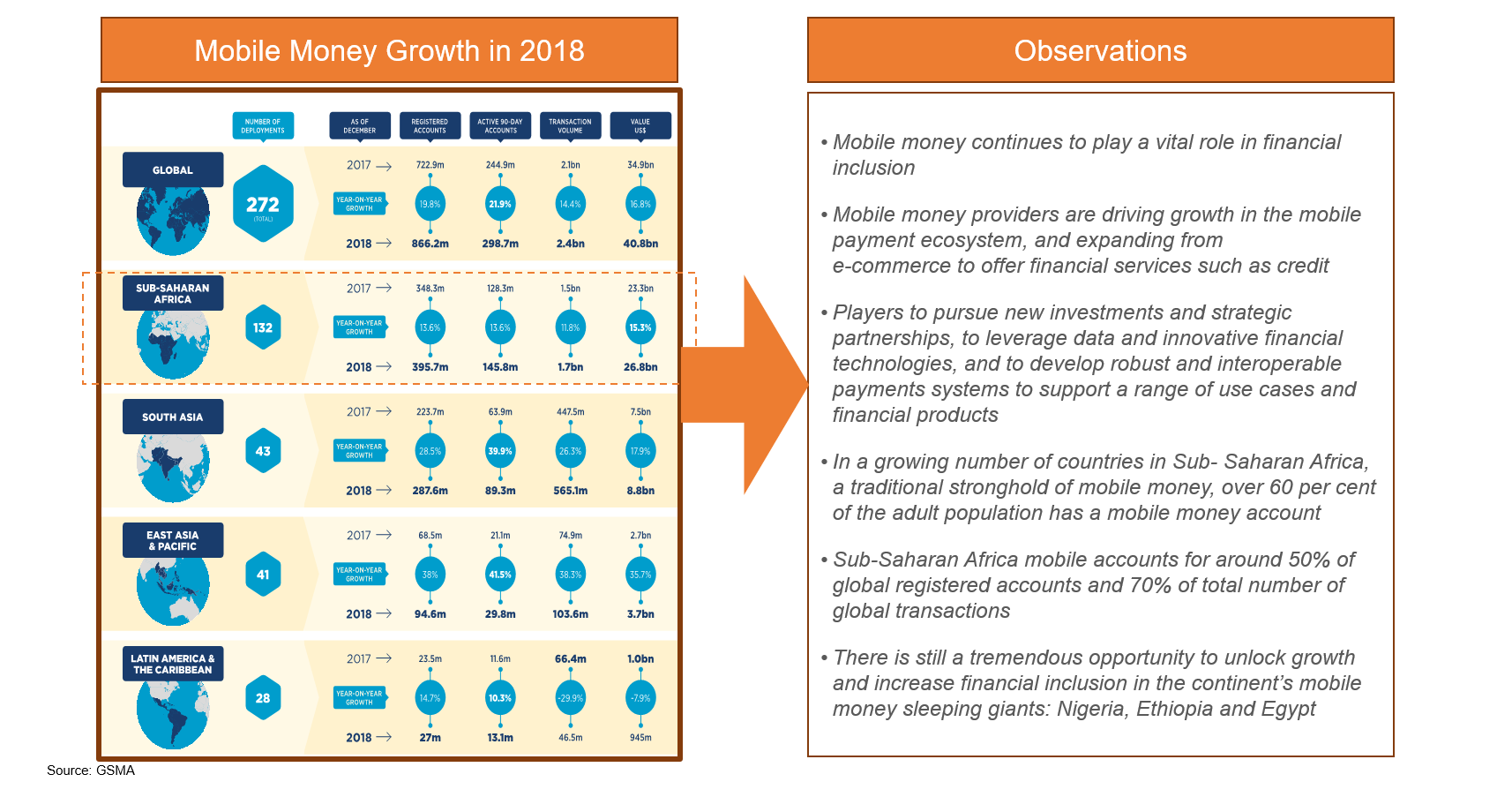

Market Overview & Potential:

African consumers are seeking accessible and affordable digital financial services, including savings, credit, insurance, and a comprehensive marketplace. There's a need for an integrated solution that allows customers to interact, transact, and send money within Africa and globally.

Market Statistics & Potential:

- Africa's population is 1.2 billion, with 700 million millennials (ages 18-36).

- 400 million Africans currently use smartphones, projected to increase to over 700 million by 2025.

- Financial inclusion is expected to reach an average of 43%.

- The forecasted market opportunity for digital financial services in Africa is $102 million by 2025.

HelloCash Wallet:

The HelloCash wallet, part of the WOS Mobile Money platform, is a versatile payment system that works with global payment networks, including international cards, mobile wallets, bank accounts, and cash transactions. It's designed to connect Africa with the global payment community through an open-loop system. Unlike traditional mobile money services, HelloCash allows complex, cross-border financial transactions and supports multiple currencies.

Partnership Approach:

HelloCash operates on a partnership basis with various payment providers to ensure seamless interoperability. Collaborations with banks, mobile money services, and international payment networks aim to simplify the process of funding HelloCash wallets, similar to services like PayPal and Revolut.

HelloCash Wallet KYC (Know Your Customer):

The KYC process for HelloCash includes basic identification measures and additional payment-related information. It also requires KYC for any linked wallets used as funding sources.

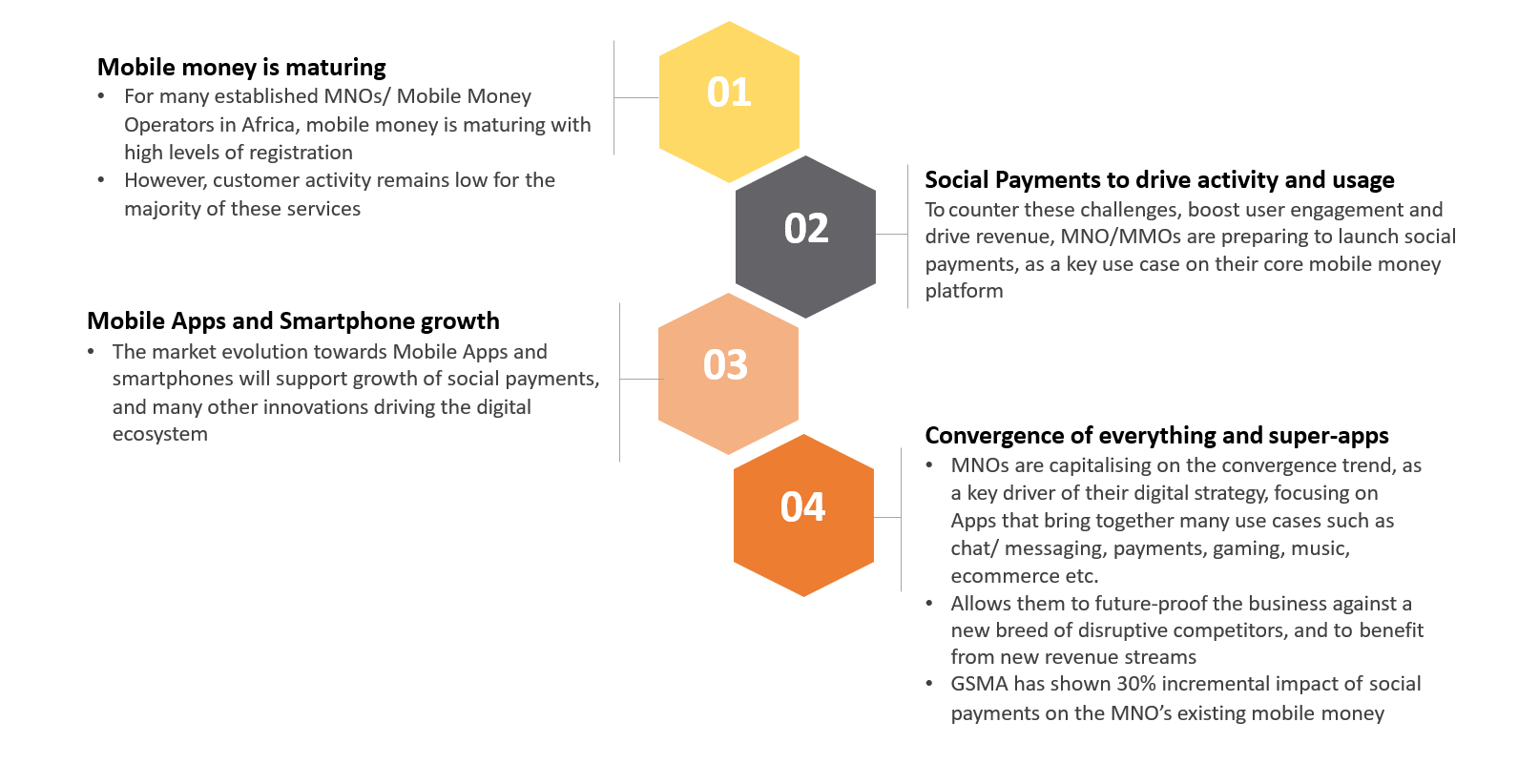

Africa Continues to be the Mobile Money Hub

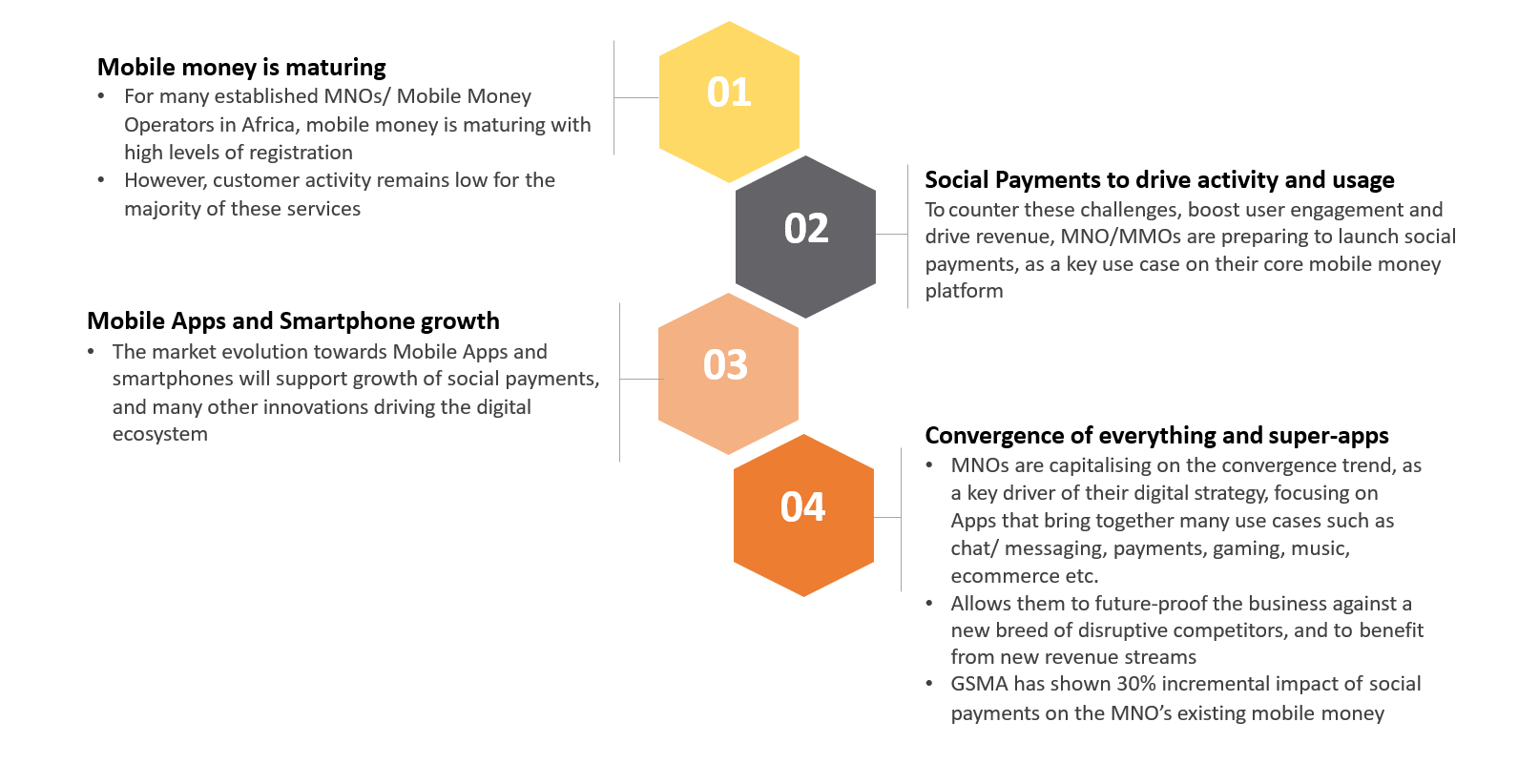

Social Payment Rational

African consumers are seeking accessible and affordable digital financial services, including savings, credit, insurance, and a comprehensive marketplace. There's a need for an integrated solution that allows customers to interact, transact, and send money within Africa and globally.

Market Statistics & Potential:

- Africa's population is 1.2 billion, with 700 million millennials (ages 18-36).

- 400 million Africans currently use smartphones, projected to increase to over 700 million by 2025.

- Financial inclusion is expected to reach an average of 43%.

- The forecasted market opportunity for digital financial services in Africa is $102 million by 2025.

HelloCash Wallet:

The HelloCash wallet, part of the WOS Mobile Money platform, is a versatile payment system that works with global payment networks, including international cards, mobile wallets, bank accounts, and cash transactions. It's designed to connect Africa with the global payment community through an open-loop system. Unlike traditional mobile money services, HelloCash allows complex, cross-border financial transactions and supports multiple currencies.

Partnership Approach:

HelloCash operates on a partnership basis with various payment providers to ensure seamless interoperability. Collaborations with banks, mobile money services, and international payment networks aim to simplify the process of funding HelloCash wallets, similar to services like PayPal and Revolut.

HelloCash Wallet KYC (Know Your Customer):

The KYC process for HelloCash includes basic identification measures and additional payment-related information. It also requires KYC for any linked wallets used as funding sources.

Africa Continues to be the Mobile Money Hub

Social Payment Rational

Made in Africa

The 'Made in Africa' market remains largely untapped and is increasingly drawing attention not only within the continent but also among the 140 million members of the African Diaspora.

Factors such as affordable labor costs, the adoption of new technologies, improved regulatory frameworks, and better access to organized logistics are significantly enhancing the ability of African suppliers to export goods made on the continent.

African culture is establishing a stronger presence on the global stage. From entertainment to goods and services, products from Africa are gaining international acclaim, positioning the continent as an influential player on the world scene.

The remarkable success of the film "Black Panther" has showcased the universal appeal and inclusivity of African culture, resonating with new generations worldwide.

The African continent has begun to export its goods and services more substantially. The development of state-of-the-art e-commerce platforms that integrate networks of small and medium-sized enterprises (SMEs) is set to boost trade both locally and internationally.

Factors such as affordable labor costs, the adoption of new technologies, improved regulatory frameworks, and better access to organized logistics are significantly enhancing the ability of African suppliers to export goods made on the continent.

African culture is establishing a stronger presence on the global stage. From entertainment to goods and services, products from Africa are gaining international acclaim, positioning the continent as an influential player on the world scene.

The remarkable success of the film "Black Panther" has showcased the universal appeal and inclusivity of African culture, resonating with new generations worldwide.

The African continent has begun to export its goods and services more substantially. The development of state-of-the-art e-commerce platforms that integrate networks of small and medium-sized enterprises (SMEs) is set to boost trade both locally and internationally.

Founders

eCommerce

Made in Africa

140 Million diasporas in the Western Nations

Contact us

- Edisonbaan 23, 3439 MN Nieuwegein, Nederland